Grow Your Construction Business with Hearth’s Financing for Contractors

Offer your customers affordable monthly payment options for every project, without losing your profits to dealer fees.

25,000+

Professionals selling with Hearth

12X

Average annual ROI

$700M

Processed loan volume through Hearth

Why Contractors Love Our Construction Financing Options

No costly per-project dealer fees.

No minimum years in business.

FICO scores as low as 550. Rates as low as 7.99% APR.

Home Improvement Financing can help your team close 17% more jobs.

Loans from $1K to $250K. Terms from 2 to 12 years.

Track your customers' financing progress.

How Our Financing for Contractors works in Three quick steps

OFFERING FINANCING

Email or text a financing link to your customers, or embed in Hearth Quotes, Contracts, and Invoices.

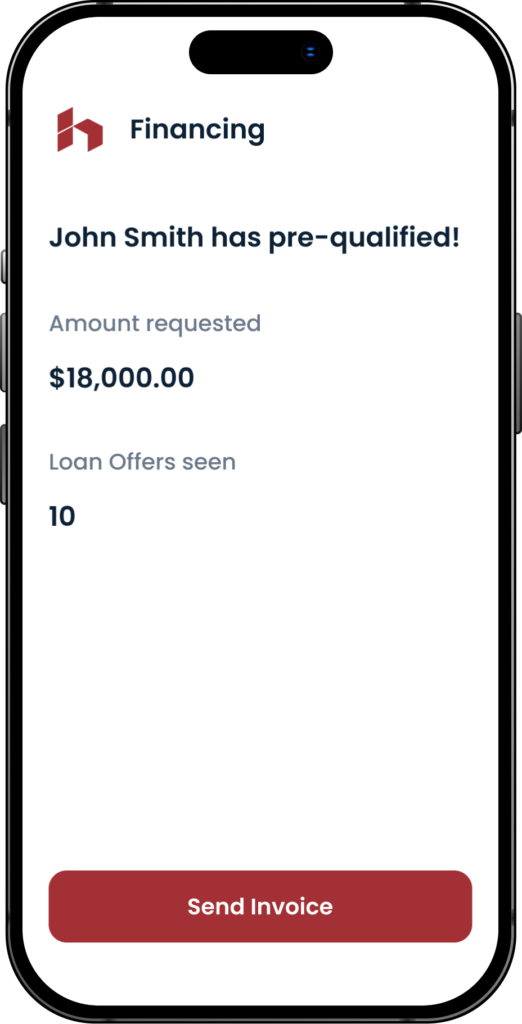

Customers Pre-Qualify

Your customers complete a short online financing form to immediately see their estimated monthly payment options, without affecting their credit scores.

For homeowners who qualify, there are 0% introductory APR credit card options available. Terms range from 6–18 months.

Construction Project gets funded

Customers apply for their preferred payment option and, if approved, receive funds in as little as 24 hours.

Offer an affordable payment plan for CONSTRUCTION clients who don’t have the cash up front

Close more deals with affordable financing and get to work faster

“Hearth has been a game-changer for me and the company. We send the financing link to our customers. We follow up, and they get funded in 24 to 48 hours. You can’t ask for more than that.”

-Semper Fidelis Construction

Give your sales team a competitive edge

- Add financing marketing banners to your website to attract and capture new leads.

- Show monthly payment options in every quote to combat sticker shock.

- Link to a financing form in every contract and invoice to make payment simple.

What our customers say

“Hearth was really a no-brainer to us, and we feel it’s a no-brainer to everyone else in the industry as well.”

-Montgomery R., General Contracting

Which Hearth plans include customer financing?

Essentials

Pro

Elite

What are the Customer Benefits?

Using Hearth to offer financing to your customers can help you win more jobs and avoid sticker shock. With Hearth, you can offer your customers affordable monthly payment options for their home improvement projects. Instead of paying a large sum for their project, they can break down their costs into smaller payments. And, with Hearth’s lending partners, there are no prepayment penalties.

With Hearth, you can also give your customers a clear idea of their buying power. If your customer pre-qualifies, they can see their options for the amount they request, but they’re also shown the highest amount they qualify for. This opens the door to project upgrades so you can make the most of every job

NO COSTLY PER-PROJECT DEALER FEES

While traditional financing companies have dealer fees from 3-20% per financed project, contractors are never charged a dealer fee by Hearth. Hearth’s annual fee gives you access to unlimited use of our financing tools for an entire year.

SOFT CREDIT CHECKS

Through your co-branded Hearth pre-qualification form, your customers can see their pre-qualified monthly payment options for their projects without a hard pull on their credit.

FICO SCORES AS LOW AS 550

Gain access to a network of 18 lenders with one pre-qualification form for FICO scores as low as 550 and loan amounts as high as $250,000.

SEND DIGITAL INVOICES AND COLLECT DIGITAL PAYMENTS WITH HEARTH

Eliminate wasted time tracking overdue payments with Hearth’s easy-to-use digital payment system. Include a financing link in your invoices to show your customers their monthly payment options.

EMBED MONTHLY PAYMENTS IN YOUR SALES PROCESS

It can be hard to have the money conversation with a customer during a sale. That’s why Hearth has made it simple to embed financing options in every quote, contract, and invoice you send so that your customers always know they have payment options.

FAQs

Customer financing is a method of financing where a contractor is able to offer monthly payments to their customers in order to help them avoid paying large sums at one time for their projects. Hearth members can offer their customers personal loans and 0% introductory APR credit cards.†

† 0% introductory APR credit cards are an add on to the Hearth membership. Speak with a Hearth account executive at 512-686-4141 for more information.

Have you ever been in a situation where you offered a quote for your services and your potential customer was not happy with the price? By offering monthly payment options to your customers, you are able to fight sticker shock and win more jobs.

Interest rates can start as low as 7.99% for personal loans but a loan’s annual percentage rate (APR) depends on credit score, debt-to-income ratio, loan amount, loan terms, and other factors.

Hearth does not offer financing directly, but our network of lenders are able to finance popular industries like; Roofing, HVAC, Plumbing, Sidings and Exteriors, Landscaping, Pools and Spas, Flooring, and Fencing.

If you do not see your industry give us a call as we may be able to find financing options for you.

To offer customer financing:

1. Provide the job quote to your customer

2. Send a financing link to the Hearth pre-qualification form to your customer

3. Send a follow-up email to your customer to confirm the form is complete and they have chosen their options

4. If approved, your customer can get funded with in 24- 48 hours

The money conversation can be tough. We recommend talking to your customers about financing as if it were like any other payment method. Explain that financing isn’t for everyone, but everyone should explore their monthly payment options because it might help them secure the project they want or need. With Hearth, you can include financing links and show estimated monthly payments at all points of the sales process using Hearth quotes, contracts, and invoices.

Hearth’s lending partners can work with FICO scores as low as 550. Customers are able to check to see if they qualify for financing without affecting their credit score.

Yes, when customers are funded by Hearth, they are able to use the funds for any home improvement project. Contractors should refer to our terms and conditions for more details.

Hearth does not charge any additional fees to customers who qualify for financing.